Create a Budget: A How-To Guide for Beginners

I've been there. It's kind of daunting when you think about it. You mean I have to adult now??! Budgeting for me was easy before I was on my own. I didn't pay rent, but I paid for a lot of other things to contribute to my parent's household.

The first thing I ever learned to create a budget on was our shared cell phone plan. My job was to figure out whose was whose regarding usage (this was before unlimited talk and text). Sometimes we went over, but just like paying your own way at a restaurant, we didn't want to just split the bill evenly when someone else went over! So that was my job, and I truly loved doing it.

The next time I had an opportunity to create a budget was when I was 14. This is when I started my first-ever job: working with my mom at our local school administrative office. I didn't work a lot -- after school and also during the summer, but this allowed me to create a budget for myself. I started saving for a car, I paid for my cell phone, and if I wanted anything special to eat, I would buy it myself.

I've created several budgets over the last few (ahem...) years--but that's the beauty of it. Budgets should evolve with you! Keep reading to see how you can create a budget as a beginner.

Create a Budget using 7 simple steps: 👊

Determine your monthly income.

List out your monthly expenses by analyzing your current expenses.

Categorize your expenses.

What are the necessary expenses per month?

Determine how much you want to save: aka "pay yourself".

Track your spending throughout the month.

Review your month and create a budget for next month.

Step 1: Determine your monthly income

The first thing is figuring out how much you earn per month. If you have a set income this will make it pretty easy to figure out, but if you're like most people and your paychecks vary from check to check, I would suggest taking an average of your paychecks. You can do this by reviewing the last few months' of paystubs, or go online to your bank account and review there if you don't have paystubs. Say you earned $1,100 the first paycheck but you got a little overtime the next round and made $1,300. Add those two up and then divide by two. That's how you get your average. Plug that into the top of your budget as your monthly income.

Step 2: Analyze your current expenses

You can do this in a few different ways. If you have access to online banking, pull up your account and see what you currently spend money on. When I did this, I realized I spent a lot of money at coffee shops! That's my downfall... I love my coffee and unfortunately for my wallet, I like the expensive "froofy" coffees. Whatever it is, if it's something that you don't want to stop, just put it in your budget! We'll get to more of this in the 4th step. This step is for analyzing what you currently spend your money on so you can organize it and make room for it in your budgeting plan.

Step 3: Categorize your expenses

The reason you should categorize your expenses is to see how much you are spending in that specific area. This could look like including all your "needs" into one group, "wants" into another, and "desires" in another. Needs would be mortgage or rent, utilities, food, and other necessary bills. Wants could look like your coffee habit for the upcoming month, or eating out at restaurants, going to the movies, etc. Desires are important. This is the category that you will set aside money into. Maybe you want to buy a house or a car. You'll want to make sure to include these expenses as well.

Step 4: What are "necessary" expenses?

Well, this means something different to everyone. In my mind, necessary is what keeps a roof over your head, and the basics to survive. Rent, utilities, gas, car payment, other debt payments, etc. Hopefully you don't have any other debt, but I realize most people have some sort of debt.

**Here is a great way to get out of debt for the 2025 year!**

You will need to determine what is necessary in your budget, but I've mostly covered the major necessities.

Step 5: Determine how much to pay yourself

Paying yourself should come first. This can come in many different ways! For example, paying yourself using a 401k, an automatic transfer to a savings account, saving for a big purchase, etc. Either way, saving should be at the top of your budget.

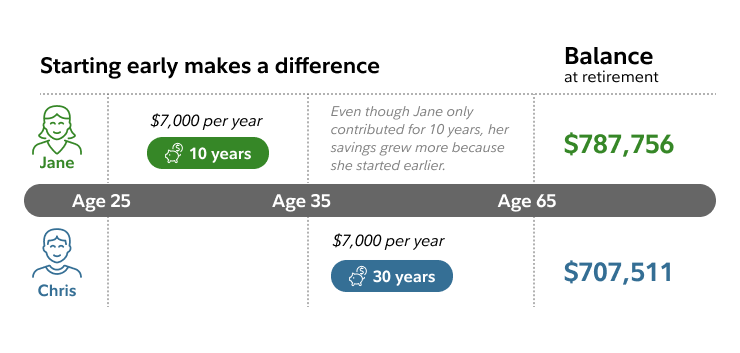

This one is certainly a personal item. Only you know what is important to you and what you want to save for in the future. Make sure you put this in your budget! If you are paying yourself in the form of contributing to a 401k, the earlier you get started on this the better. This is because of something called compound interest (see below example).

Step 6: Track your budget throughout the month

Tracking your budget throughout the month is critical. You need to check in and ensure you're still on track for the goal you set for yourself at the beginning of the month. I've tried a lot of different ways to stay on track of my budget throughout the month and the number one way I've found is using cash.

Budgeting this way has saved me a lot of money. It is so easy to swipe our debit card whenever we want something and this is a very easy way to derail yourself. See how I budget paychecks and by using cash here.

Step 7: Review your month and make a plan for next month

This might be the most important step of all. We can call it the MIS. Reviewing what you spent this month will really help you for next month. I guarantee you there will be something that you overspent on this month that you will need to rein in for next. That's okay!! Everyone has been there, you can't be perfect right off the bat.

The purpose is to learn your spending habits and move on from there. Remember, you're learning how to create a budget. Even if you're a seasoned pro, if you are getting yourself back on track, you still might forget something.

Final thoughts for you

My parting statement to you is: start now! You won't get your budget under control by just figuring it out when all the money is gone. Get the free budget bundle today!

Facebook

Instagram

X

LinkedIn

Youtube

TikTok

Pinterest