Frugal Habits To Teach Your Kids That Are Becoming Extinct!

Ever wonder how to teach frugal habits to your kiddos? I've thought of this often over the past few years as my husband and I embark on our frugal lifestyle.

My kids are getting old enough to handle their money independently and I want them to grow up with good habits around money.

So I made some chore charts

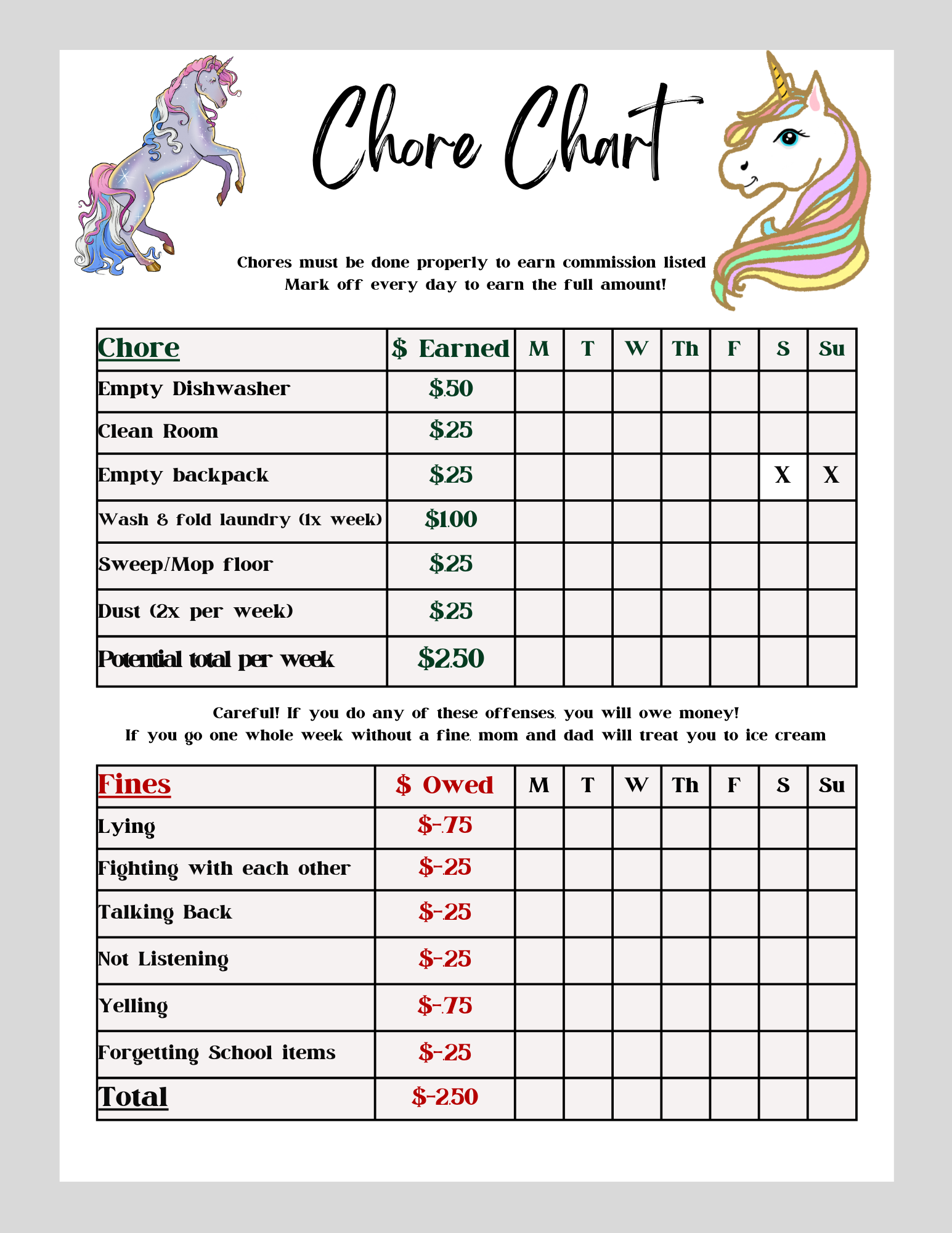

They've had chores for as long as I can remember, within reason of course. You're not going to have a 2-year-old doing the same things as a 7-year-old. In order to get my older two excited about earning their own money, I recently introduced this chore chart (below) for them. I tailored it to each of them due to what they were already doing around the house but we put an amount next to it to show them their potential earnings. (please note, these are in CENTS, not whole dollar amounts. $.25 = 25 cents :) )

I pay my kids in "commission" rather than allowance, so I included a fines section on the chore chart. As you can see, the chores I assign are everyday chores, like cleaning rooms, emptying your backpack, putting dishes away, etc. These need to get done anyway, but I hope I'm teaching them responsibility and how to take care of themselves when they get older and aren't at Mom and Dad's house!

They can earn up to $2.50 weekly, so $10/month. When they get a little older, these amounts will go up, and we will assign different chores as well. Whatever they end up earning (because depending on the fines, some may be deducted) we expect them to tithe and save first, then they can put some in their "spend" category. We break it down for them into dollar amounts since that's easier for them rather than percentages, but $5 goes to savings, $2 to give, and $3 to spend.

Frugal Habits that are making a comeback

Pay with cash

Pay yourself first

Tithe

Try not to veer off the list when spending

This isn't rocket science peeps.....

Paying in cash

Paying with cash was a HUGE step for my family. We can't pay for cash with everything, but our expenses that can (and DO!) get out of hand sometimes, we do. When it comes to the kids, they don't need to worry about that, of course, but they've learned that they can't buy anything unless they have the cash on them to do so.

For instance, we went to our local mall a couple of weeks ago, and my daughter wanted to go to Claire's. She wanted to buy some jewelry but didn't have any cash with her and wanted her dad and me to buy it for her. I explained to her that this is like purchasing on credit, and there can be repercussions for this (aka interest). She and I both knew she had plenty in her savings account so I said if she still wanted it, we would go to the bank and withdraw the cash and she could spend it.

I don't want them creating bad habits right from the start by borrowing from Mom and Dad when they have the money in their account!

Tithing/Giving

We're teaching tithing and giving to align with what God says in the bible. What's really awesome though is my kids WANT to and make it a priority every week when we go to church. As I said above, they put aside $2 a month to tithe from the commission they earn, but they might also tithe in addition to that if they got cash for their birthday or something.

Pay yourself first

This is important because, without savings, you can't pay for bigger purchases down the road. It's never too early for kids to start saving for their first big purchase (a car for instance). My husband and I both worked with our parents so we started earning money from a job early on. We both were able to pay for our first vehicles in cash. Granted, we didn't start at 7 and 9, but you get my point!

Try not to veer off the list

I'm sure everyone knows what I mean when I say this! It's easy to let spending get out of hand if you go somewhere (like grocery shopping). Usually when I go grocery shopping, at least one of my kids comes with me. This is a good time to teach them not to veer off the list. They get annoyed with me a little bit because they want EVERYTHING, but if it's not on the list, it means we don't NEED it. I'm not saying don't give in to wants at times, but make sure it aligns. This is how I keep our grocery budget under $100/week: saying no to the extras.

What I want my kids to learn is that you can splurge sometimes, but when it gets to the point where it's all the time, something needs to change.

Frugal habits can lead to lifestyle discipline

Think about it: if you're teaching kids to be frugal with money, they will eventually learn to be patient and wait for things. They will look forward to what they are waiting for rather than it being just another thing that they lose interest in after a while.

Growing up my family and I didn't have a lot of extra money to spare and I truly believe that what my parents instilled in me by saving and being patient is what has helped me in my adult life. We did standard chores around the house and got paid, which is why I'm passing this on to my children.

I believe that little things can add up to something big down the road and foster responsible kids as well.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok

Pinterest