Get A Month Ahead On Your Mortgage (or rent!)

As an Amazon Associate, I may earn commission from qualifying purchases that you make at no additional cost to you.

WOW! I never thought we could get a month ahead on our mortgage, especially on just one income! But we did! And I am so excited to share with you the steps I took (and still take) to get more than just one month, and get the whole emergency savings stashed up!

This was especially hard for us, because our mortgage keeps going up! Thanks to where we live being one of the “fastest growing cities” in America. This translates to “your property taxes are going up!” and then translates to “your mortgage is going up!”. Man, let me tell you, I dreaded opening that escrow statement that came out a few weeks ago because I knew it would mean more of my paycheck is going to our mortgage, even though I’m not making a lot more!

Anyway, recently we were able to get a full month ahead on our mortgage. What I mean by this is we’re a month ahead on paper. I have our mortgage payment ready to pay our February payment and I had the full payment before we paid our January payment. The reason for this is because of our budget!

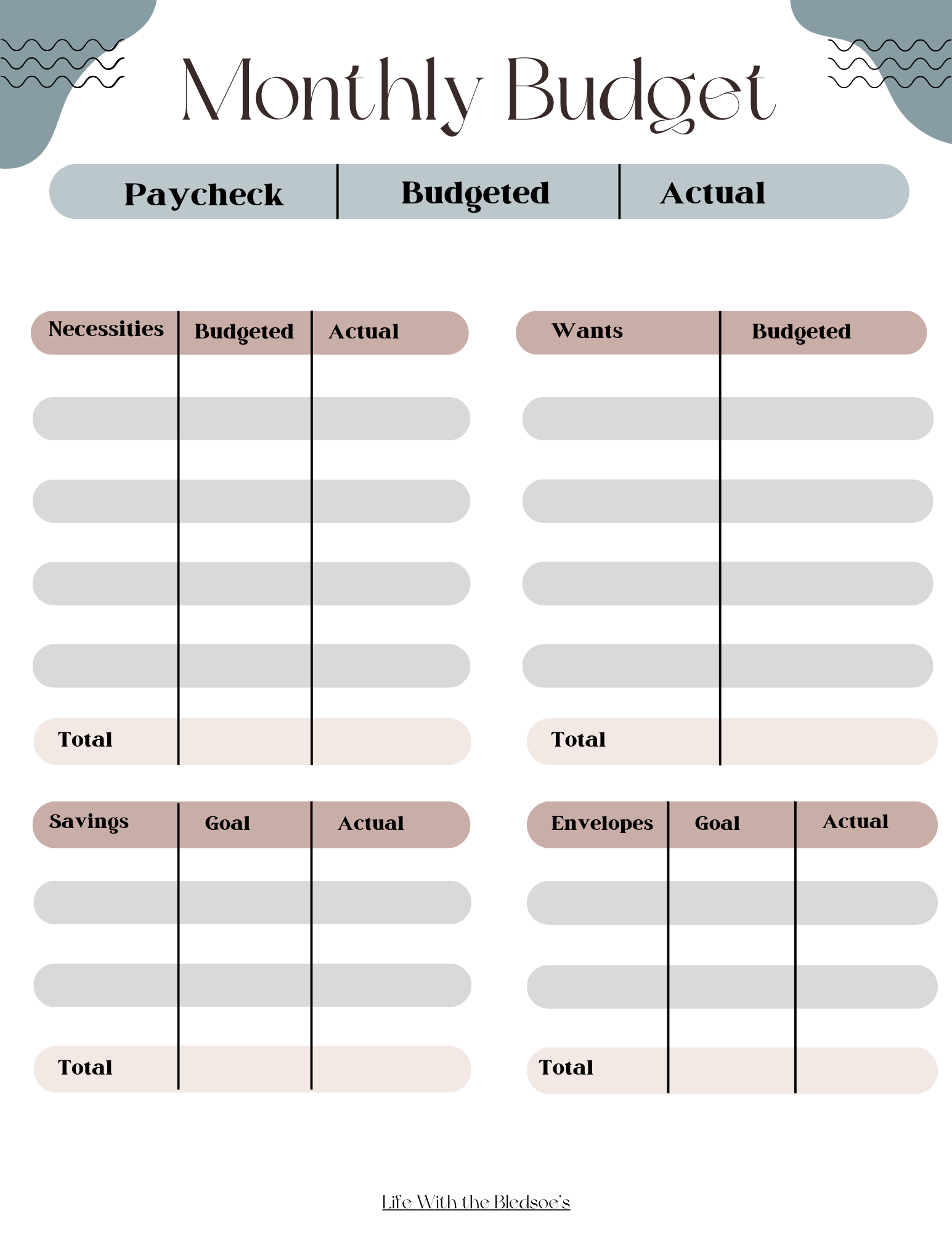

Month ahead budgeting

My husband and I budget every dollar we have, whether that is savings, bills, or doing something fun. I get paid every two weeks, and that means I get paid 26 times over the year rather than 24. This has allowed us to get ahead on some expenses.

To be on the safe side, I transfer the half payments to another account that we don’t really look at. With it being in a different account, it’s safe from any accidents that could happen.

Once I am ready to pay that bill (or when it's ready to auto-draft), I transfer the money back to our main account. Simple and easy.

Another tip for this if you think you might dip into it: make sure you don't have easy access. This means remove it from your online banking, don't take a debit card for it, and don't set up any other bills to come out of that account!

Give your dollars a purpose

With our budget, I split our mortgage into half payments. I deduct it from every paycheck that I get. I write down each paycheck's bills and then I deduct it out of my checkbook.

It takes perseverance and dedication to not spend it even though technically it’s “extra”. Many people might ask why I’m doing this? The reason is so my family and I can get that much closer to realizing our dreams of being debt-free! We also want to have a full emergency fund. Doing things like this will help my family and I get there!

Why would you want to get a month ahead?

You’re reading this for a reason, and I think the reason for that is you want to get ahead on your bills!

This is probably the hardest one to get ahead on because for most of us, our mortgage or rent is the bulk of our paychecks. But won’t it be so nice when you can pay for next month’s bills with last month’s paycheck?? It’s easier said than done, but you have to start somewhere.

Getting a month ahead on your mortgage means that you could make an extra payment, or it could truly serve as a cushion for you.

Think of this as a start to your emergency fund. According to most experts, we all should have at least three to six months of expenses saved. If you get a month ahead on the mortgage, you can move on to your other bills and start funding that emergency fund of yours.

Can I still get a month ahead if I am paycheck to paycheck?

Short answer is: Yes you sure can!!

I am in the same boat now and I got a month ahead with my budget. We became a one-income 😮 family shortly before Christmas of 2023. Which meant we had to buckle down starting with Christmas gifts. We bought these roller skates for the kids and I ended up getting some, too, which has been so much fun! I don't necessarily recommend going full-bore when you're in your late 30's though, unless of course you have already been exercising 😆

Christmas was already in the budget prior to going to one income, but we weren’t quite to our goal. Knowing that, we got creative and actually ended up spending less than what we had in our Christmas savings.

This helped us get ahead with our mortgage because what was left from that fund went towards our “month-ahead” bills.

It takes time and dedication, but once you start with an actual budget, you, too, can get a month ahead on your bills.

Final thoughts

Getting ahead on bills is certainly difficult. Whether you have a spouse, family or you're single. What I do know is if you stick to your guns and find different ways, you can definitely get a month ahead on some of your bills.

You can start small rather than going full on with your mortgage, too. If you have a car payment, start with that! Just start! That's the most important thing you can do for yourself and for your family.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok

Pinterest